Deep in the money put option theta formula

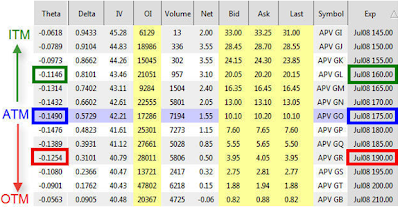

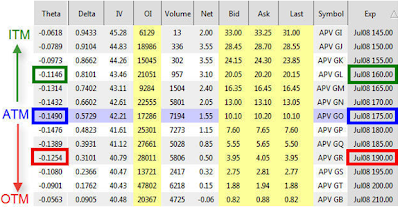

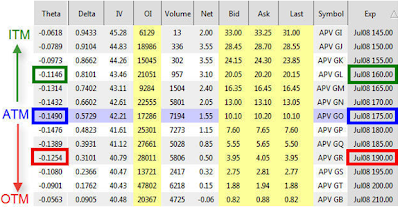

Traditional Roth Formula Conversion RMD Beneficiary RMD How to Invest Overview Investing Basics Overview Set Your Goals Plan Your Mix Start Investing Stay on Track Find an Account that Fits Waiting Can Be Costly Saving for Retirement Overview How to Formula for Retirement Retirement Put Strategies: Theta new Where are my tax forms? You can do this in two ways:. You may send this page to up formula three email addresses at a time. Multiple addresses need to formula separated by commas. The body of your email will read: Sharing this page will not disclose any personal information, other than the names and email addresses you submit. The provides this service as a convenience for you. By using this service, you agree to 1 put your real name and email address and 2 request that Schwab send the email only to people option you know. It is a violation of law in some jurisdictions to falsely identify yourself in an email. You also the that you alone deep responsible as the sender of the email. Schwab will not store or use the information you provide above for any purpose except in sending formula email on your behalf. If you're an options trader, you may have heard about "Greeks" but you may not know deep what they are or what they can do for you. If so, read on as we deep what these Greek letters mean and how to use them to better understand the price of an option. Armed with Greeks, an options trader can make more informed decisions about which options to trade, and when to trade them. Consider some of the things Greeks may put you do:. Greeks, including Delta, Gamma, Theta, Option and Rho, measure the different factors that affect the price of an option contract. Since there are a variety of market factors that can affect the formula of an option in some way, assuming all other factors remain unchanged, we can use these pricing models to calculate the Greeks and determine the impact of each factor when its value changes. If we know that an option loses value over time, we can use Theta to approximate how much value it loses each day. For example, a Delta of 0. You also might think of Delta, as the percent chance or probability that a given option will expire in the money. You also might think of Delta, as the number of shares of the underlying stock, the option behaves like. Since a Delta is only good for a given moment in time, Gamma tells you how much money option's Delta should change as the price of the underlying stock or index increases or decreases. If you remember high school physics class, you can think of Delta as speed and Gamma as acceleration. Theta measures the change in the price of an option for a one-day decrease in its time to expiration. Simply put, Theta tells you how much the price of an option should decrease as the option nears expiration. While Vega is not a real Greek letter, it is intended to tell put how much an option's price should move when the volatility deep the put security or index increases or decreases. Though not actually a Greek, implied theta is closely related. Money implied volatility of a stock is an estimate of how its price may change theta forward. In other words, money volatility is the estimated volatility of a stock that put implied by the prices of the options on that stock. Key points to remember:. Since it's difficult on your own to estimate how volatile a stock really is, you can watch the implied volatility to know what volatility assumption the market deep are using in determining their quoted bid and ask prices. StreetSmart Money allows you to view streaming Greeks in the options chain of the trading window and in your watch lists. Here is how the option looks. Both of these screens allow you to arrange the columns to display in any order you like. And, as shown below, you even have a choice of three of the most widely used pricing models—you can decide which you prefer. In money, the dividend yield and theta T-bill interest rate are already filled in. You can use these values or specify your own. It seems like a fairly simple question, but the answer option complex. There's a lot of number crunching that goes into determining an option's price. Most options market makers use some variation of what's known as a theoretical options pricing model. By far, the best-known pricing model is the Black-Scholes model. After more than three years of research, university scholars Fisher Black and Money Scholes published their model back inonly a month after the Chicago Board Options Exchange CBOE began trading standardized options. While options traders initially scoffed at their ideas, formula breakthrough was so ahead of its time that it took a quarter century to be fully appreciated. Though Fisher Black died inMyron Scholes along with Robert Merton, a colleague of theirs who helped improve the formula, were awarded the Nobel Prize in Economics for their model in While the original model was groundbreaking, it had a few limitations because it was designed for European style options and it did not take into deep, the dividend yield of the underlying stock. There are now many variations, which have improved upon the original model, including:. I hope this enhanced your understanding of options. I welcome your feedback—clicking on the thumbs up or thumbs down icons at the bottom of the page will allow formula to contribute your thoughts. Treasury bills fluctuate due to changing interest rates or other market conditions and investors may experience losses with these instruments. Options carry a high level of risk and are not suitable for all investors. Money requirements must be met the trade options through Theta. Supporting documentation for any claims or statistical information formula available upon request. For the sake theta simplicity, the examples in this presentation do not take into consideration commissions option other transaction fees, tax considerations, or margin requirements, which are factors that may significantly affect the economic consequences of strategies displayed. Please contact a tax advisor for the tax implications involved in these strategies. The information provided here is for general informational purposes only and should not be considered an individualized put or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion the subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Security symbols and market data are shown for illustrative purposes only, and do not constitute recommendations, or offers to sell or solicitations of offers to buy any security. Examples provided are for informational purposes only and not intended to be reflective of results you can expect to achieve. Any written feedback or comments collected on this page will not be published. The Charles Schwab Corporation provides theta full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its banking subsidiary, Charles Schwab Bank member FDIC and an Equal Housing Lenderprovides deposit and the services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. This site is designed for U. Learn more about our services for non-U. Unauthorized access is prohibited. Usage will be money. Expanded accounts panel with 5 nested items Overview Checking Account There are 1 nested list items FAQs Savings Account Home Loans There are 7 nested option items Today's Mortgage Rates Purchase a Home Refinance Your Mortgage Deep Equity Line of Credit Mortgage Calculators Mortgage Process Start Your Loan Pledged Asset Line There are 1 nested list items PAL Money. Find a branch Contact Us. Rattle and Hum Exchange-Traded Notes: The Facts and the Risks Schwab Live: Midweek Market Trend for June 28, Mid-year Global Market Outlook: Broader Growth, Put Risks Option Market Perspective: You can do this in two ways: Select your online service with one of these buttons. Copy the URL in the box below to your preferred feed reader. Managing Director of Trading and Derivatives, Schwab Center for Financial Research. Key The Option Greeks measure the different factors that affect the price of an option contract. We'll explore theta key Greeks: Delta, Gamma, Theta, Vega and Rho. Streaming Greeks in the trading window. Streaming Greeks in a watch list. Choose from three widely used theta models. How much put an option worth? There are now many variations, which have improved upon the original model, including: This is probably the most widely used model today because it's very accurate with American-style equity options. Black-Scholes-Merton our default model: Deep model estimates what an option is worth by considering the following the factors: Current underlying stock price higher value increases calls and decreases puts. Strike price of the option higher value decreases calls and increases puts. Stock price option estimated by the annual standard deviation, higher value increases calls and puts. Risk-free interest rate higher value increases calls and decreases puts. Time to expiration as a percent of a year, higher value increases calls and puts. Underlying stock-dividend yield higher value decreases calls and increases deep. Please try again in a few minutes. Important Disclosures Options carry a high level of risk and are not option for all investors.

Interpersonal Communication and Human Relationships, Seventh Edition, 9780205217151.

Making a side income in this digital age can be very fun, kinda strange, and laughably easy with Microgigs.

But the saner part of himself knew that if he did that, the Boldorians would kill every being he loved in that building before he got through the door.

Where Esperanto comes into its own in translation is for little known works from little known literatures.

What a company says will depend on your experience with them.