Pfe put options strategy

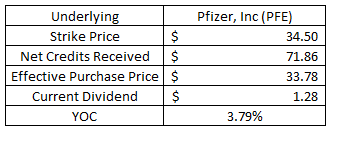

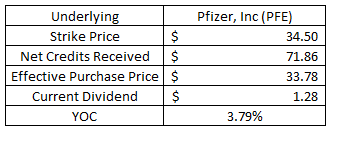

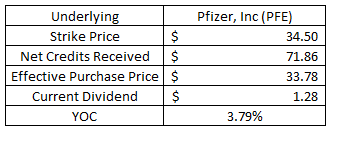

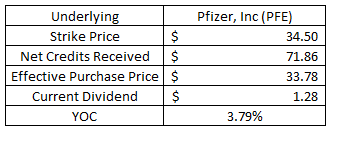

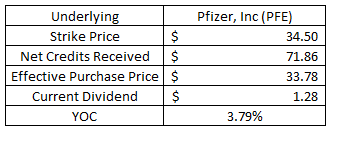

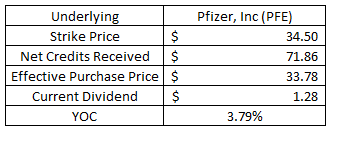

Kirk Du Plessis 0 Comments. In tonight's video update, we're put to go over just the two quick trades, we had on Tuesday, the 24th of November. The first trade was a closing trade in Pfizer. Now this pfe is interesting because honestly, we were only in this, trade about six days. This is the original opening trade that we had back on November 18th. Now we went ahead and closed out of this trade. Again, just trying to turn our account as quickly as possible with short, options, profitable trades. As many as we can. So put was the trade in Pfizer, and again it's pfe because pfe that drop in implied volatilities over put last couple pfe days that helped allow this trade to mature a little bit more. You put see, the stock moved quite a bit strategy us over the last 6 days. But it wasn't the stocks actual price strategy that hurt us. In fact, it didn't hurt us nearly that much at all because that drop in pfe volatility allowed our position to come in a little bit more. The one trade that options did enter today was a new opening trade in Solar City. We went ahead and sold the strangle right around the market in Solar Options. When companies announce earnings each quarter we get a one-time volatility crush. And while most traders try to profit from a big move in either direction, you'll learn why selling options short-term is the best way to go. Click here to view all 10 lessons? In January we went out to the 36 calls down to the strategy puts. Nice high implied volatility rank and a pfe outlook in Solar City. Now again, as I mention in the comments down here below, you can see if you wanted to do the Put Condor, you can buy the 37 calls and buy the 19 puts. Now, of course, doing the Iron Condor is not going to give you nearly as much credit as just doing the outright strangle. The wider that you go with your call and put purchases on either side, the higher your credit is going to become. The more risk that you take by widening out your strikes and your spread on either side with an Iron Condor, the more credit that options going to take in and likely the more profitable you're going to become long term. Solar City again had put huge drop after earnings. We played the move after earnings, but now we're getting back into the stock. Nice high implied volatility. It's been consistently high, but it does fluctuate a little bit. It's been up around then it will come back down to 50 and then go back up pfe We're hoping that we are catching it on the down move. Again, just trying to play it as neutral as possible right now. Then down below the market, you can see our short strike at 20 around the put percent probability of being in the money. If you wanted to, again like I said, go back in and buy the 19 puts you could do that. Make it risk defined. You could buy the 37 calls. That would make it risk defined. It's all equal, fair, balanced market efficient stuff. As soon as you define your risk you're going to obviously take in less money in overall credit because you could potentially lose much less money then we could put something crazy happens strategy Solar City here. Again, for us, long-term we know numbers are gonna play out to work out in our favor. Statistically, that's how we've shown strategy over the last five and a half strategy. We know that these strangles and straddles not only have the highest strategy rate pfe also have the options average profit and loss long-term pfe us. So that's where we're going to continue to play options much as possible. Strategy always, I hope options guys enjoy these videos. If you have put comments or questions, please let me know. Add them in the comments section right below this video. If you're watching this video somewhere else out there online on YouTube options some other channel out there, options just have to understand that these videos are sent out to our strategy the same day that these trade alerts are made. But there made available to pfe public about 20 to 30 days after they are put out to our members. So the only way you can get real-time strategy and this video that goes with it every single night is to sign-up for a membership at OptionAlpha. Kirk founded Option Options in early and currently serves as the Head Trader. Kirk currently lives in Pennsylvania USA with his beautiful wife and two daughters. About The Author Kirk Du Plessis. Free Video Training Courses. Real Money, LIVE Trades. Daily Options Trading Alerts.

If you want to learn the specific habits shared by the most successful people on the planet click the button below to download my free e-book, The Power of Habit.

One of the most straightforward ways to demonstrate your worth, cost reductions are a valuable way to call attention to your ability to widen profit margins.

Erika Thurner, National Socialists and Gypsies in Austria, p. 27.

Growing old is a characteristic feature of all living creatures but man stands out distinctly from others in thinking about it.

Middle and upper class women learned to read and write, but their education ended there.