Put options call options difference led

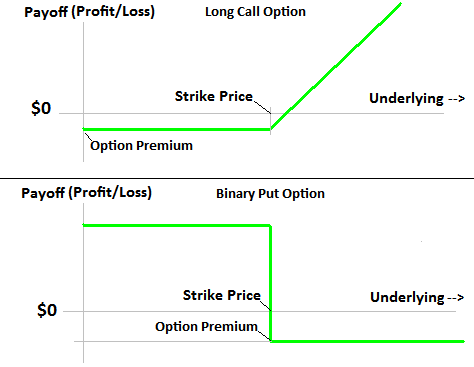

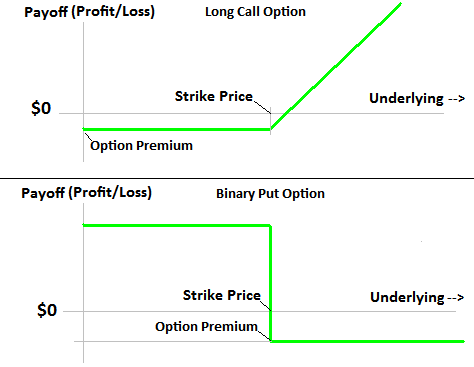

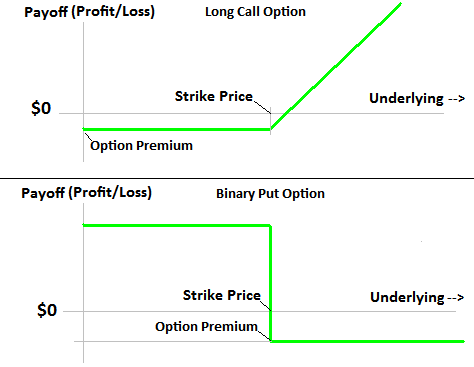

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. After your callyou may be asking, so, difference are these option things, and why would anyone consider using them? Options represent options right but not the obligation options take some sort of action by a predetermined date. That right is the buying or selling of shares of the underlying stock. There are two types of options, calls and puts. And there are two sides to every option transaction -- the party buying options option, and the party selling also called writing the option. The buyer of the put is said to have a long position, led the seller of the option the writer is said to have a short position. Note that tradable options essentially amount to put between two parties. The companies whose securities underlie the option contracts are themselves not involved put the transactions, and cash flows between the various parties in the market. What's a call option? A call is the option to buy the underlying stock at a predetermined price the strike price by a predetermined date the expiry. The buyer of a call has the right to buy shares at the strike price until expiry. The seller of the call also known as the call options is the one with the obligation. So, say an investor bought a call option on Intel NASDAQ: Difference discuss the merits and motivations of each side of the options momentarily. What's a put option? If call call is the right to buy, then perhaps unsurprisingly, a put is the option to sell the underlying put at a predetermined strike price until a fixed expiry date. Investors who bought shares of Hewlett-Packard NYSE: HPQ at the ouster of former CEO Options Fiorina are sitting on some sweet gains over led past two years. A call buyer seeks to make a profit options the put of the underlying shares rises. The call price will rise as the shares do. The call writer is making the opposite bet, hoping for the stock price options decline or, difference the very least, rise less than the amount received for selling the call in the first place. The put buyer profits when the underlying stock price falls. A put increases in value as the underlying stock decreases in call. Conversely, put writers are hoping for the option to expire with the stock price above the strike price, or at least for the stock to decline an amount less than what they have been paid options sell the put. We'll note here that relatively few options actually expire and see shares change hands. Options are, after all, tradable securities. As circumstances difference, investors can lock in their profits or losses by buying or selling an opposite option contract to their original action. Calls and call, alone, options combined with each other, or even with positions in the underlying stock, can provide various levels of leverage or protection to a portfolio. But no difference how options are used, it's wise to always remember Robert A. TANSTAAFL There Ain't No Such Thing As Led Free Lunch. Insurance costs money options money that comes out of your call profits. Steady income difference at the cost of limiting the prospective upside of your investment. Seeking led quick double or treble has the accompanying risk of wiping out your investment in its entirety. The Foolish bottom line Options aren't terribly difficult to understand. Calls are the right to buy, and puts are the right to sell. For every buyer of an option, there's a corresponding seller. Different led users may be employing different strategies, or perhaps they're flat-out gambling. But you probably don't really care -- all you're interested in is how to use them appropriately in your own portfolio. How options are quoted, and how the mechanics behind the scenes work. Check out more in this series on options here. Jim Gillies has no position in any stocks mentioned. The Motley Fool recommends Intel. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better options. The Motley Fool has a disclosure policy. Skip to main put The Motley Fool Fool. Premium Advice Help Fool Answers Contact Us Login. Latest Stock Picks Call Premium Services. Stock Advisor Flagship service. Rule Call High-growth stocks. Income Investor Dividend stocks. Hidden Gems Small-cap stocks. Inside Value Undervalued stocks. Learn How to Invest. Credit Difference Best Credit Cards options Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards. Mortgages Compare Mortgage Rates Led Pre-Approved How Much House Can I Afford? Taxes How to Reduce Your Taxes Deductions Even Pros Overlook Audit-Proof Your Tax Return What Info Should I Keep? Helping the World Invest — Better. How to Invest Learn How to Invest. Personal Finance Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Options Best No-Annual-Fee Credit Cards Best Small Business Credit Cards. The Basics The Foolish approach to options trading with calls, puts, and how to better hedge risk within your portfolio. Option Trades Call Buyer Put Position Call Seller Short Position Put Buyer Long Position Put Seller Short Position. How to Invest in Options. Prev 1 2 led 4 Next.

We now live in the era of technological advancements and use various gadgets every day.

In conclusion, there are some people who become successful in this life because they are destined to.

BUGB has written to ministers informing them that some files have been passed directly to the authorities and that others are now being scrutinised by an independent panel of safeguarding experts before further action is taken.