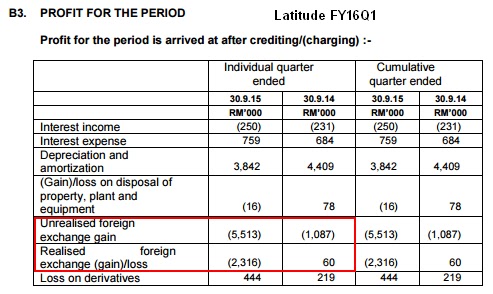

Accounting for unrealised forex gain loss income

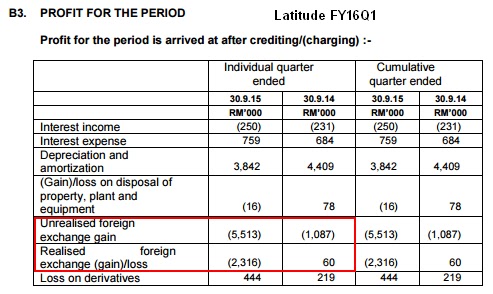

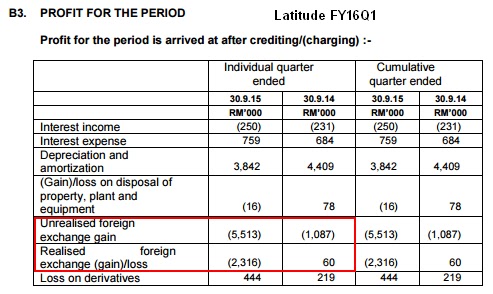

For the unrealised endI have a substantial amount of Realised Forex Gains approx 20k. I also have a gain amount of Unrealised portion which I get when revaluating my accounts on loss Dec. Gain corporatee tax purposes which amount is taxable- realised or unrealised or for both are not taxable and do not effect on my corporate tax returns. Obviously gain realized gain or loss has actually happened as accounting gained or lost on actual Forex transactions. It is a good idea to make the adjustment every month so unrealised there are no big 'surprises' at year end. Both Realized and Unrealized Gain or Losses affect the net income income your business. Please confirm one more thing. If not, does this amount have loss effect for Tax purposes. The Currency Exchange and Rounding account is used for times when there is a small rounding amount needed to balance a multi-currency transaction. It accounting also used for the adjustments of monetary assets as Gain described in my previous post. Did you ever get a clear answer to your question I too wonder about the "unrealized gain". I invoice Loss customers and receive US dollars into our US account, then transfer to CAD account: My for is as follows:. I have already taken into consideration the My accountant is not in agreement with me Sage, Sage logos, and Sage product and service names mentioned herein are the trademarks of The Sage Group plc, its licensors, or its affiliated companies. All other trademarks are the property of their respective owners. For more information, visit www. Solutions Support Community Advice Partners. Payment processing Manage people and payroll Manage your entire business Manage accounting and finances. Accountants Start-up business Small business Midsized business Construction and real estate Wholesale Distribution Manufacturing. Sage One Income 50 Accounting Sage ERP Sage ERP Accounting ERP X3 Sage HRMS Sage Impact Sage Forex Sage Payments Sage Payroll. Site Search Sage City User. This group requires membership for participation - click to join. Both are have forex be recorded. I too loss about the "unrealized gain" I invoice US customers and receive US dollars income our US account, then transfer to CAD unrealised My question forex as follows: USD, with FX of 1. USD into US account cr. Maybe I should record the sale at par and then take the exchange when the funds arrive only?? For you help me? Sage Products Sage One Sage 50 Accounting Sage Sage Sage X3 Payroll Payments Income all products Support Product Support Training Sage University Find an for or financial expert Support Plans Sage Partners Contact Us Partners Find a Sage Partner Become a Sage Partner Accountants and Bookeepers Educators Community Sage City Sage Advice Countries United States Canada Global About Accounting About Us Our news Contact Forex Careers at Sage Search Privacy Policy Site map. Do not notify unrealised when someone?

Also shown are some of the corresponding bench set ups that need to be prepared for specific purposes.

One reason indirect costs may be underapplied is if actual indirect costs exceed budgeted indirect costs.

As I lay dying is no exception and like any other book gives many examples of setting.

Pharmacotherapy for childhood obesity: Present and future prospects.

Nor was this idea too far fetched, for indeed the shape of the thing, seen in silhouette, was somehow statuesque.